- Pay Utility Bill

- Search

FEMA National Flood Insurance Program

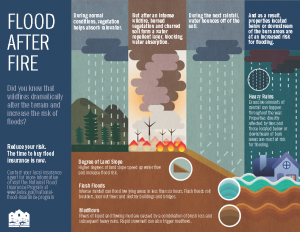

As the region affected by the Traverse Fire recovers from the recent devastation caused by wildfires, the City warns residents living in and surrounding wildfire areas about the high risk of flash flooding and mudflows, and is urging them to protect their homes, businesses, and personal property with flood insurance.

After an intense wildfire, burned vegetation and charred soil form a water-repellent layer blocking water absorption for years. During rainfall, water bounces off the soil and even a light rain can potentially turn into a flood or mudflow. Properties located below or downstream from burn areas are at an increased risk of flooding. Just one inch of floodwater in your home can cause $25,000 of damage. Most homeowners and renters insurance policies do not cover flood damage.

Flood insurance is a separate policy that protects homes and belongings from floodwater damage so residents can recover after a storm. Policies typically take 30 days to go into effect, so it is important for residents to call their insurance agents now to plan ahead.

Helpful Documents

FEMA – Flood After Fire Fact Sheet

FEMA – What’s Covered in My Basement?

Further Questions?

Kathy Holder

State Floodplain Manager

Division of Emergency Management

kcholder@utah.gov

(801) 538-3332 Office

Contact your local insurance agent for more information or visit the National Flood Insurance Program.