- Community

- Parks & Recreation

- Services & Information

- Government

- Departments

- Lehi Fiber

- Pay Utility Bill

- Search

Revenue & Taxation

Lehi City is funded primarily through two categories of revenue: taxes and fees. Tax revenue is primarily used to pay for services provided to the public in general such as police, fire, streets, and parks. The City also provides services that benefit specific groups of citizens for which a specific fee is charged, which is intended to pay for all or part of the costs incurred to provide that service. The City adheres to the following revenue policies:

- The City should maintain a diversified and stable revenue system to shelter it from unforeseeable short-run fluctuations in any one revenue source.

- The City should estimate revenues conservatively on an annual basis to avoid unexpected deficits and to provide a funding source for capital project needs.

- The City should minimize the use of one-time revenue to fund ongoing services.

- The City should annually review the full costs of activities supported by user fees, impact fees, license and permit fees, and special assessments to 1) identify the impact of inflation, 2) determine that the full long-term service costs are not being subsidized by general revenues or passed on to future generations of taxpayers, 3) determine the subsidy of some fees, and 4) to consider new fees, subject to the review of City Council.

- The City should seek to maintain a stable tax rate.

The above chart shows the ten-year trend for those revenue sources classified as general taxes and as building permit fees. In total, these five sources are expected to comprise approximately 77% of the General Fund revenue. It is important to maintain balance among major revenue sources. The remainder of this webpage will provide additional information on the major general fund revenue sources used to fund the City’s general government services. User fee revenue information can be found on the Finance Department page. User fees are based on an analysis of how much of the cost should be covered by the fee versus how much should be subsidized by general taxes and revenue. Factors considered in the analysis include:

- How Lehi’s fees compare with those charged by other cities,

- Whether the service benefits the general public versus an individual user, and

- Whether the same service can be offered privately at a lower cost.

Sales Tax

General sales tax is one of Lehi City’s largest revenue sources at just over 40 percent of the estimated General Fund revenue for FY 2025. State law authorizes cities to receive sales tax revenue based on the process described in the chart shown below. Normally, sales tax revenue fluctuates more with the economy than the other major tax revenue sources. However, commercial growth has continued to hold steady with the addition of Class A office space and several commercial developments.

(This image is being included to illustrate how sales tax is distributed. Current rates should be verified with the State Tax Commission.)

Property Tax

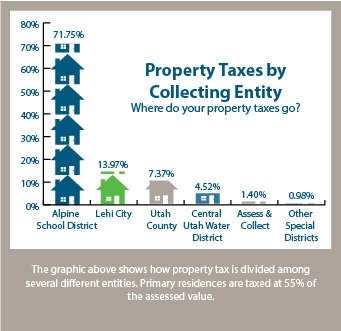

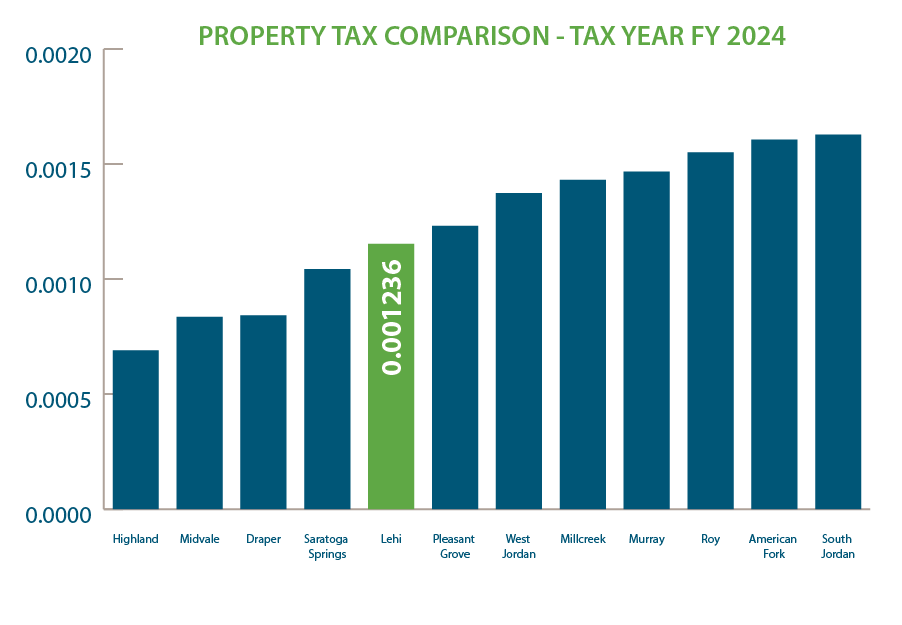

Property tax is another one of Lehi City’s largest sources of tax revenue, accounting for about 27% of General Fund revenue. In Fiscal year 2014, Lehi’s Finance Department started combining current property taxes, motor vehicle taxes, and delinquent taxes into one property tax line item. Utah County assesses the taxable value of property in Lehi and collects property tax. Lehi City’s FY 2025 certified property tax rate is 0.001236. Primary residences are taxed at 55% of the assessed value while secondary residences are taxed at 100% of the assessed value. Lehi City receives approximately 14% of what Lehi residents pay in property taxes (see graph below).

Maintaining an average rate for many years, property tax revenues have stayed relatively stable. When compared to other cities in Utah of a similar size, Lehi has maintained a relatively average property tax rate for many years which has helped to mitigate against the need for a significant rate increase in any single given year.

Franchise Tax

Franchise taxes are the third largest source of revenue for the general fund, accounting for approximately 9% of total General Fund revenues. State law authorizes cities to collect up to 6% in utilities operating within city boundaries.

Motor Vehicle Tax

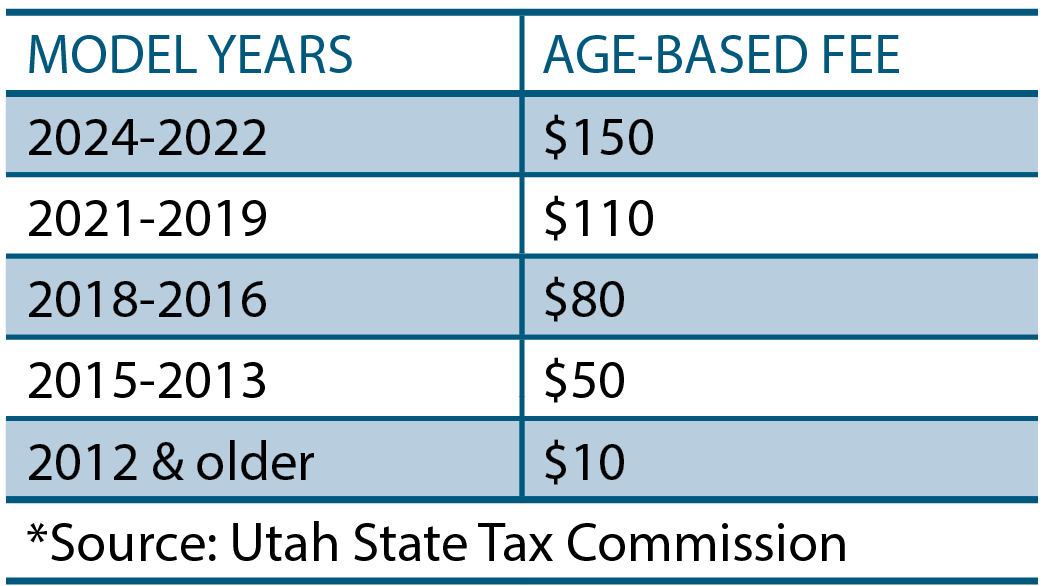

A statewide fee is assessed on motor vehicles in lieu of property taxes. The fee is assessed based on the age of the vehicle. Historically, this source of revenue accounted for just under 3% of all General Fund revenues. Lehi’s Finance Department now tracks motor vehicle tax revenue with property tax and delinquent taxes under one line item. A breakdown of how the Motor Vehicle Tax is assessed is provided below: